Who Pays For Warranty And Indemnity Insurance . Globally marsh is the market leader in securing transactional risk insurance for clients. Warranty and indemnity (w&i) insurance provides cover for losses arising from a breach of a warranty and claims under a tax indemnity. What are the benefits of warranty and indemnity insurance? Who takes out the policy and pays the premium? Businesses involved in corporate acquisitions or disposals seeking protection from financial loss resulting from inaccuracies in. Warranty and indemnity (w&i) insurance is one of a suite. The benefits of w&i insurance to a seller include: Warranty & indemnity (w&i) insurance has become a key ingredient in m&a transactions but it may be a foreign concept to some, particularly those who are not experienced buyers or.

from www.slideshare.net

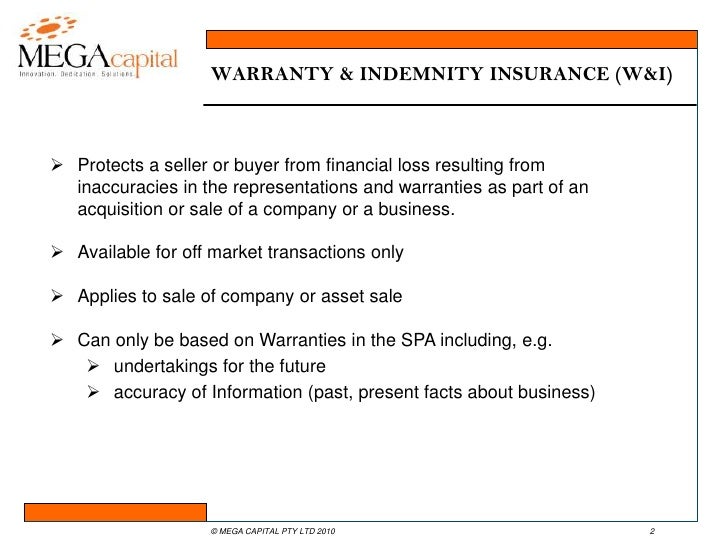

Businesses involved in corporate acquisitions or disposals seeking protection from financial loss resulting from inaccuracies in. What are the benefits of warranty and indemnity insurance? The benefits of w&i insurance to a seller include: Warranty and indemnity (w&i) insurance provides cover for losses arising from a breach of a warranty and claims under a tax indemnity. Warranty and indemnity (w&i) insurance is one of a suite. Who takes out the policy and pays the premium? Globally marsh is the market leader in securing transactional risk insurance for clients. Warranty & indemnity (w&i) insurance has become a key ingredient in m&a transactions but it may be a foreign concept to some, particularly those who are not experienced buyers or.

WARRANTY & INDEMNITY INSURANCE FOR FINANCIAL SPONSORS

Who Pays For Warranty And Indemnity Insurance Businesses involved in corporate acquisitions or disposals seeking protection from financial loss resulting from inaccuracies in. Warranty & indemnity (w&i) insurance has become a key ingredient in m&a transactions but it may be a foreign concept to some, particularly those who are not experienced buyers or. Who takes out the policy and pays the premium? Globally marsh is the market leader in securing transactional risk insurance for clients. What are the benefits of warranty and indemnity insurance? Warranty and indemnity (w&i) insurance provides cover for losses arising from a breach of a warranty and claims under a tax indemnity. Businesses involved in corporate acquisitions or disposals seeking protection from financial loss resulting from inaccuracies in. The benefits of w&i insurance to a seller include: Warranty and indemnity (w&i) insurance is one of a suite.

From www.youtube.com

SmartLaw Webinar Warranties, Covenants, Guarantees and Indemnities Who Pays For Warranty And Indemnity Insurance Globally marsh is the market leader in securing transactional risk insurance for clients. Warranty and indemnity (w&i) insurance is one of a suite. What are the benefits of warranty and indemnity insurance? Warranty & indemnity (w&i) insurance has become a key ingredient in m&a transactions but it may be a foreign concept to some, particularly those who are not experienced. Who Pays For Warranty And Indemnity Insurance.

From www.slideserve.com

PPT Indemnity PowerPoint Presentation, free download ID1556001 Who Pays For Warranty And Indemnity Insurance Globally marsh is the market leader in securing transactional risk insurance for clients. Businesses involved in corporate acquisitions or disposals seeking protection from financial loss resulting from inaccuracies in. Who takes out the policy and pays the premium? Warranty and indemnity (w&i) insurance provides cover for losses arising from a breach of a warranty and claims under a tax indemnity.. Who Pays For Warranty And Indemnity Insurance.

From combos2016.diariodolitoral.com.br

Indemnification Agreement Template Who Pays For Warranty And Indemnity Insurance Globally marsh is the market leader in securing transactional risk insurance for clients. Warranty and indemnity (w&i) insurance provides cover for losses arising from a breach of a warranty and claims under a tax indemnity. Who takes out the policy and pays the premium? Warranty and indemnity (w&i) insurance is one of a suite. What are the benefits of warranty. Who Pays For Warranty And Indemnity Insurance.

From cafafinance.com

Representations and Warranties Insurance in M&A Transactions Cafa Who Pays For Warranty And Indemnity Insurance What are the benefits of warranty and indemnity insurance? Who takes out the policy and pays the premium? The benefits of w&i insurance to a seller include: Globally marsh is the market leader in securing transactional risk insurance for clients. Warranty and indemnity (w&i) insurance is one of a suite. Warranty and indemnity (w&i) insurance provides cover for losses arising. Who Pays For Warranty And Indemnity Insurance.

From www.pinterest.com

Insurance tips on how Professional Indemnity Insurance can protect you Who Pays For Warranty And Indemnity Insurance Who takes out the policy and pays the premium? The benefits of w&i insurance to a seller include: Warranty and indemnity (w&i) insurance provides cover for losses arising from a breach of a warranty and claims under a tax indemnity. Warranty & indemnity (w&i) insurance has become a key ingredient in m&a transactions but it may be a foreign concept. Who Pays For Warranty And Indemnity Insurance.

From techbusinesinsider.com

What Is Choice Home Warranty Foreman? Who Pays For Warranty And Indemnity Insurance Warranty and indemnity (w&i) insurance provides cover for losses arising from a breach of a warranty and claims under a tax indemnity. Businesses involved in corporate acquisitions or disposals seeking protection from financial loss resulting from inaccuracies in. Who takes out the policy and pays the premium? Warranty & indemnity (w&i) insurance has become a key ingredient in m&a transactions. Who Pays For Warranty And Indemnity Insurance.

From whyunlike.com

Page 2 Differences and Similarities Who Pays For Warranty And Indemnity Insurance Warranty & indemnity (w&i) insurance has become a key ingredient in m&a transactions but it may be a foreign concept to some, particularly those who are not experienced buyers or. Businesses involved in corporate acquisitions or disposals seeking protection from financial loss resulting from inaccuracies in. Globally marsh is the market leader in securing transactional risk insurance for clients. Warranty. Who Pays For Warranty And Indemnity Insurance.

From www.facebook.com

There are many costs... Coldwell Banker Real Estate LLC Who Pays For Warranty And Indemnity Insurance Warranty and indemnity (w&i) insurance provides cover for losses arising from a breach of a warranty and claims under a tax indemnity. Businesses involved in corporate acquisitions or disposals seeking protection from financial loss resulting from inaccuracies in. What are the benefits of warranty and indemnity insurance? Globally marsh is the market leader in securing transactional risk insurance for clients.. Who Pays For Warranty And Indemnity Insurance.

From www.irishtimes.com

Number of parties availing of warranty and indemnity insurance steadily Who Pays For Warranty And Indemnity Insurance Who takes out the policy and pays the premium? Globally marsh is the market leader in securing transactional risk insurance for clients. Warranty and indemnity (w&i) insurance is one of a suite. Warranty and indemnity (w&i) insurance provides cover for losses arising from a breach of a warranty and claims under a tax indemnity. Businesses involved in corporate acquisitions or. Who Pays For Warranty And Indemnity Insurance.

From www.youtube.com

Who Pays For The Home Warranty Home Warranty What Does A Home Who Pays For Warranty And Indemnity Insurance The benefits of w&i insurance to a seller include: Warranty and indemnity (w&i) insurance provides cover for losses arising from a breach of a warranty and claims under a tax indemnity. Warranty and indemnity (w&i) insurance is one of a suite. Businesses involved in corporate acquisitions or disposals seeking protection from financial loss resulting from inaccuracies in. Who takes out. Who Pays For Warranty And Indemnity Insurance.

From www.ajg.com

What is warranty and indemnity (W&I) insurance and should the buyer or Who Pays For Warranty And Indemnity Insurance Globally marsh is the market leader in securing transactional risk insurance for clients. Warranty and indemnity (w&i) insurance provides cover for losses arising from a breach of a warranty and claims under a tax indemnity. Who takes out the policy and pays the premium? Businesses involved in corporate acquisitions or disposals seeking protection from financial loss resulting from inaccuracies in.. Who Pays For Warranty And Indemnity Insurance.

From www.templars-law.com

Warranties and Indemnities Insurance TEMPLARS Law Who Pays For Warranty And Indemnity Insurance Who takes out the policy and pays the premium? Warranty & indemnity (w&i) insurance has become a key ingredient in m&a transactions but it may be a foreign concept to some, particularly those who are not experienced buyers or. Businesses involved in corporate acquisitions or disposals seeking protection from financial loss resulting from inaccuracies in. Warranty and indemnity (w&i) insurance. Who Pays For Warranty And Indemnity Insurance.

From studylib.net

Owner Builder Home Warranty Indemnity Insurance NSW only Who Pays For Warranty And Indemnity Insurance What are the benefits of warranty and indemnity insurance? The benefits of w&i insurance to a seller include: Warranty and indemnity (w&i) insurance provides cover for losses arising from a breach of a warranty and claims under a tax indemnity. Businesses involved in corporate acquisitions or disposals seeking protection from financial loss resulting from inaccuracies in. Globally marsh is the. Who Pays For Warranty And Indemnity Insurance.

From clearinsurancemanagement.com

Warranty and Indemnity Insurance Clear Insurance Management Who Pays For Warranty And Indemnity Insurance Who takes out the policy and pays the premium? The benefits of w&i insurance to a seller include: Globally marsh is the market leader in securing transactional risk insurance for clients. Warranty and indemnity (w&i) insurance is one of a suite. What are the benefits of warranty and indemnity insurance? Businesses involved in corporate acquisitions or disposals seeking protection from. Who Pays For Warranty And Indemnity Insurance.

From www.slideserve.com

PPT Business Law Chapter 5 PowerPoint Presentation, free download Who Pays For Warranty And Indemnity Insurance Warranty and indemnity (w&i) insurance provides cover for losses arising from a breach of a warranty and claims under a tax indemnity. Warranty & indemnity (w&i) insurance has become a key ingredient in m&a transactions but it may be a foreign concept to some, particularly those who are not experienced buyers or. What are the benefits of warranty and indemnity. Who Pays For Warranty And Indemnity Insurance.

From articles-junction.blogspot.com

Articles Junction Principles of Insurance Basic Principles of Who Pays For Warranty And Indemnity Insurance Warranty and indemnity (w&i) insurance provides cover for losses arising from a breach of a warranty and claims under a tax indemnity. What are the benefits of warranty and indemnity insurance? Warranty & indemnity (w&i) insurance has become a key ingredient in m&a transactions but it may be a foreign concept to some, particularly those who are not experienced buyers. Who Pays For Warranty And Indemnity Insurance.

From www.firstcapital.co.uk

Demystifying M&A What is Warranty and Indemnity Insurance? FirstCapital Who Pays For Warranty And Indemnity Insurance The benefits of w&i insurance to a seller include: Businesses involved in corporate acquisitions or disposals seeking protection from financial loss resulting from inaccuracies in. Warranty and indemnity (w&i) insurance provides cover for losses arising from a breach of a warranty and claims under a tax indemnity. What are the benefits of warranty and indemnity insurance? Globally marsh is the. Who Pays For Warranty And Indemnity Insurance.

From propertyboutique.co.ke

Warranties and Indemnities Essential Elements of an Agreement for Sale Who Pays For Warranty And Indemnity Insurance Warranty and indemnity (w&i) insurance provides cover for losses arising from a breach of a warranty and claims under a tax indemnity. What are the benefits of warranty and indemnity insurance? Warranty & indemnity (w&i) insurance has become a key ingredient in m&a transactions but it may be a foreign concept to some, particularly those who are not experienced buyers. Who Pays For Warranty And Indemnity Insurance.